Deep Alpha Fund

| Full Name | : TrustLine Holding Pvt. Ltd. |

| Founded | : 2004 |

| Heasquarter | : Chennai, India |

| SEBI Registeration No. / Year | PMS : INP000002254 / 2007 AIF : IN/AIF3/18-19/0580/2018 |

| Product(s) | PMS : Intrinsic Value Fund : Intrinsic Floater Fund AIF : Intrinsic Dep Alpha Fund |

| Assect Under Management (AUM) | : INR 350 Cr+ |

| Core Belif | : We win, When you win. |

Arrived from a perfect blend of highly successful and proven models of Financial Valuation by Benjamin Graham and Market Research by Philip Fisher. We look at the economics of a business, and not on the price-action or market-action. We believe in protecting the principal first, and then growing it at an above-average long-term rate of return while adhering to the Margin of Safety (MoS).

Our approach to stock selection is bottom-up, stock-specific from under-researched / under- discovered universe with huge emphasis on Intrinsic Value (Free Cash Flow), Return on Equity (RoE) and MoS.

In simple words, we look at profitable businesses with superior long-term economic characteristics (durable competitive advantage), run by astute and honest managements, and are available at attractive valuations with reasonable MoS.

Creating RICH portfolios from SMALL gems

Manager Commitment

Mandate of this fund is to create long term wealth by delivering significant outperformance over benchmark index over a 5 year horizon through a well managed portfolio of listed stocks handpicked as per deep value investment model in the small and micro cap space.

Small sized fund (SME & Microcap Focus) - This allows us the luxury to target highly promising companies in the micro cap space (sub 500 Crore market capitalisation).

Ahead in the value curve - Early investment in companies which are in their infancy thus having the potential to deliver exceptional returns when they scale up.

High on risk-reward - Positioned close to PE fund, much ahead of PMS.

Hidden gems - Companies which are very unlikely to be in the radar of competition due to their small size.

High growth industries - Stock picks are likely to be more concentrated in high growth sectors like Speciality chemicals, Niche engineering, Industrial brands, Auto ancillaries, Education, Software products, Healthcare, Renewable energy and such other promising sectors.

Returns Maximisation - Fund tenure aligned to capitalize on the five-year market cycles.

Being a micro cap focussed fund, the following avenues (not exhaustive) exist for the Fund Manager to build meaningful positions in companies;

Investment Approach - We come from school of Value Investing with huge focus on capital preservation. The underlying approach is to identify businesses that have superior moat in terms of economics, durable competitive advantage, high return ratios (return on capital employed) and robust free cash flows that are available at attractive bargain prices. The approach to stock selection is bottom-up, stock specific from under-researched and under-discovered universe with huge emphasis on Intrinsic value. The other critical component of our investment approach is the undeterred focus on downside risks. Our key objective is to protect the principal and deliver alpha returns over the long term. We strive to meet this stringent objective through our steadfast commitment to the concept of “Margin-Of-Safety” in all our investment choices.

It is our strong belief that much of the long-term returns come from the price paid than from the earnings growth. Margin of Safety usually arises from mispricing in the markets. The reason for valuation mispricing could be cyclical nature of the business, stock specific or sharp corrections driven by market cycles. We will closely watch to capitalize on such market opportunities to deliver value to our clients.

Our research process is a very exhaustive one that has evolved over a long operating history from hits and misses from the fund manager’s rich investing experience of over 15+ years. It is structured around four critical dimensions, say tenets. It starts with the first tenet of Business Evaluation, goes onto Financial Evaluation, then to Management Evaluation and finally to Valuation tenet. The process employs about 500+ checklists, screens and filters across these four tenets to evaluate the business and valuation in exhaustive details. These data points are captured in turn in due-diligence template for recording and future review.

Further it is complemented by field work and market survey that is carried out (scuttlebutt approach) to ratify the observations captured in the template. Once this process is completed, the fund manager undertakes a direct meeting with the management to assess the overall rationale behind investment post which the final decision is taken.

A critical component of our investment strategy is “Heads you win, tails you don’t lose” approach vide Margin-Of-Safety (MOS) model. This calls for a calibrated approach to deployment of cash when it comes to taking long-term positions by capitalizing on the mispricing opportunities which don’t present often. This means lot of time is spent in waiting for the fat pitch. So how do we make sure that cash is not lying idle or fetches meagre returns? This is where Warren Buffett’s “Workout” wonder comes into play. It is Advantage Arbitrage. The trick is to tout for tactical short-term opportunities, but without the market risks. Event based arbitrage is one such tactical model that can help to add glitter to the portfolio without carrying the mark-to-market (MTM) risks. They are primarily short-to-medium term opportunities driven by event based corporate actions like buyback, open-offer and other special situations including mergers, de-mergers and de-listing. The most interesting aspect of this tactical allocation model based on arbitrage is that, while it enhances the portfolio returns in the short-term by serving as a superior substitute for cash parking, it releases the cash at the most opportune time (during corrections) for enabling long-term portfolio building.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

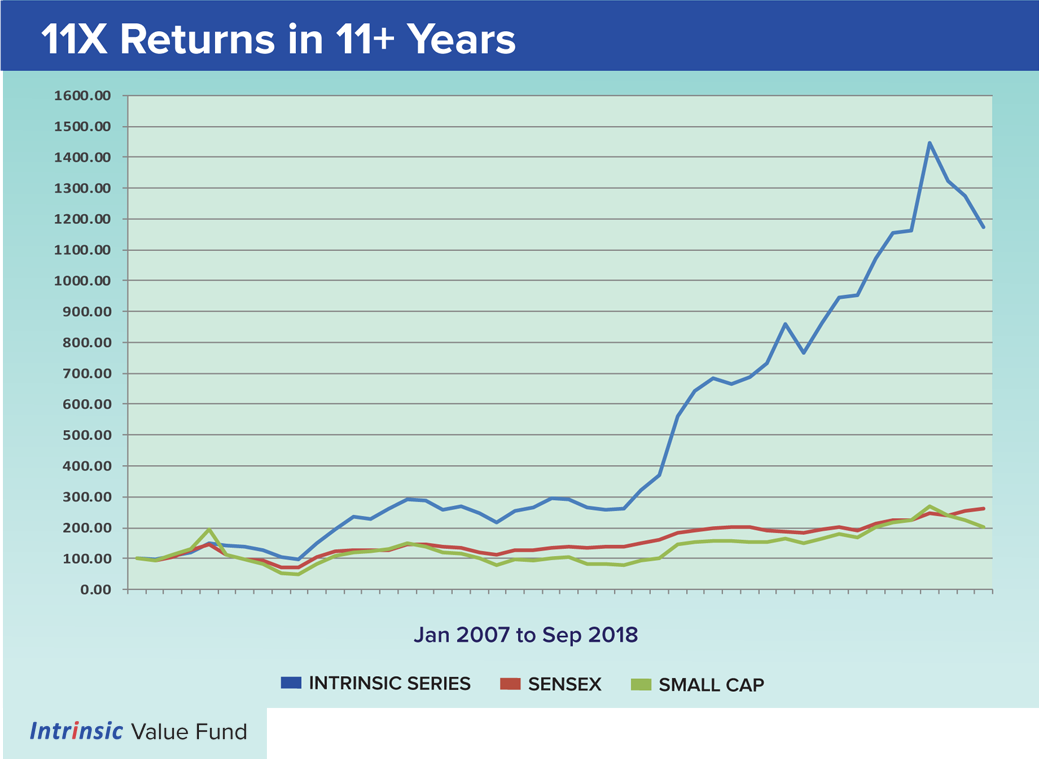

Our highly successful Intrisic Value Fund (PMS) has been a winner right through

Arunagiri N

Founder CEO & Chief Investment Officer

Vijaykumar B

Vice President - AIF Operations & SME Domain

Deepan Sankaranarayanan

Senior Research Analyst

Senior Consultant - Research

Vijay Kumar S

Advisor for Arbitrage fund management

Arun will be the CIO for the fund. Arun runs the PMS operations at TrustLine as its Chief Investment Officer and as Founder CEO. Under his able fund management, the firm manages over Rs.350+ crores of AUM for over 400+ highly satisfied clients. TrustLine is among the top discretionary portfolio managers in India with industry leading performance i.e. delivering over 23.11% (as on 30th Sept. 2018) annualized returns over the last 11+ years (since the inception of the fund).

As an enthusiastic and disciplined practitioner of Value Investing over long time, Arun has come to believe that key to success in Value Investing lies not so much in financial skills, but in emotional and temperamental skills. He believes very strongly that Value Investing is a great wealth-building opportunity for anyone who could think and act long-term without getting swayed by the short-term swings of the market.

Arun has more than 14 years of experience in capital markets in various capacities. Over the past 14 years of TrustLine’s evolution, he has played the role of Chief Investment Officer and Founder CEO. He set up TrustLine in year 2004 after his illustrious career spanning over 15 years in Wipro Ltd., one of the country’s leading Information Technology companies, where he held various senior management positions across diverse functions. He brings with him an enviable track record in Equity and Financial Research. Arun has built a huge expertise in small and mid cap space. He is a thought leader in Value Investing and he has built a leadership position for TrustLine in the Value Investing space with his enviable track record of creating long-term wealth for his fund from identifying hidden gems at a early stage in the small and midcap segment, much before market starts rerating them. Arun is an Engineering Graduate from REC, Trichy with additional qualification in "Business Finance and Financial Analysis" from ICFAI. His disciplined practice of “Value Investment” principles has enabled TrustLine to deliver superior risk adjusted returns with significant out-performance over bench-mark indices.

Vijayakumar brings with him an enviable track record in management assessment in the SME space by virtue of his long stint in leading financial services firms including Cholamandalam Investment & Finance Co Ltd where he was heading the SME vertical till recently. He will be responsible for management assessment for the companies that are under research in the SME space,

besides being responsible for complete AIF operations that includes Regulatory compliance, Risk management, Client services, reporting and the entire gamut of AIF backend. He has a Post Graduate Diploma in Management (MBA) from IIM, Bangalore with rich industry experience of 25+ years.

Deepan will be responsible for the research activities for the fund. He has been with TrustLine for the last 3 years and has been assisting the CIO on managing the PMS fund. Prior to joining TrustLine, he was with IDBI capital and HSBC InvestDirect. He gained significant research experience on the sell side by spending about 9 years in various investment companies in Mumbai. In TrustLine, he has been responsible for identifying potential investment

opportunities within the Indian Mid and Smallcap sectors and creating financial models, reports and valuation for companies under the portfolio. Besides, he also does review and recommends the portfolio stocks for TrustLine PMS. He actively interacts with the company managements of the underlying portfolio companies on a regular basis discussing about their new business strategies, new products, new market entry and any change in the business model. Deepan Sankaranarayanan, has done B.Com, PGDBA (Finance & Marketing).

Deepan will be actively supported by a senior research consultant based out of Mumbai.

This consultant’s primary responsibility is for the research activity in the SME and micro cap space. The locational advantage will give this consultant a huge management access that is critical for SME and microcap research.

Vijay will be responsible for the research activities in the arbitrage and special situations space for the fund. He has been an arbitrage consultant for TrustLine for last 14 years and has been assisting the CIO on managing the arbitrage fund in the PMS business. He is a Post-Graduate Diploma in Management (MBA) and an Engg. Graduate with over 22 years of Industry experience. Significant part of his career was with Dun & Bradstreet where he gained rich experience in security analysis and equity markets.

He also brings in rich experience in Business Strategy & Development from his tenure in Reliance Infocom. Vijay has an enviable track record in co-managing the arbitrage fund and he has to his credit in identifying large number of special situation opportunities for the PMS arbitrage portfolio. Some of his early research identifications that have worked brilliantly for the arbitrage portfolio include stocks like DIC India, PNB Gilts, Monsanto, Orient Paper, ElantasBeck, Onmobile, Kaveri Seed and so on. Vijay has gained significant research experience on arbitrage side of the portfolio vide his long consulting tenure at TrustLine.

We see significant potential in some of the high growth sectors such as Speciality chemicals, Niche engineering, Industrial brands, Auto ancillaries, Education, Software products, Health care and Renewable Energy. To help identifying promising companies in these sectors at very early stage of their growth cycle, we have constituted an advisory panel of eminent professionals. They are professionals cherry picked with rich experience in the domains of Banking, Financial services, Information technology & Engineering. They will validate the business models of companies shortlisted for investment and further help in evaluating the competence of the managements with respect to their ability to tap the burgeoning economic growth ahead.

Investments are subject to market risks and hence there can be no assurance or guarantee that the objectives will be achieved. Also, the value of the portfolio being Investments in Securities may go up or down, depending on the various factors and forces affecting the capital market.

Investors in the fund are not being offered any guaranteed / assured returns.

Past performance of the Fund or Investment Managers is not an indication of the future performance of the Fund or Investment Managers.

This material is not an offer to sell or a solicitation to buy any securities or any financial instruments mentioned in the report. TrustLine Holdings (P) Ltd / TrustLine Advisors LLP and their officers and employees may or may not have a position with respect to the securities / other financial instruments mentioned herein.

All opinions and estimations included in this report constitute our judgment as of this date and are subject to change without notice.